ARE YOU TAKING ADVANTAGE OF SECTION 179?

SECTION 179 CAN BE STRESSFUL FOR SMALL BUSINESSES! SLIM CAPITAL CAN HELP!

With a variety of programs to meet the needs of smalls businesses, we are here to help you grow!

We can turn around your APP ONLY decisions for up to $300,000 in no time so you can score points with your clients! Don't forget, we can go up to $3,000,000 with financials.

SECTION 179 IN 2022 – HOW CAN IT HELP YOUR BUSINESS?

If you own a small business, the Section 179 deduction is one of the most important tax codes you need to be familiar with in 2022. It lets you deduct all or part of the cost of equipment that is purchased or financed and put into place before December 31, 2022. It’s a good idea to become familiar with this tax incentive so you can plan for your company’s future as it relates to capital equipment purchases. And let SLIM Capital help with they equipment acquisitions.

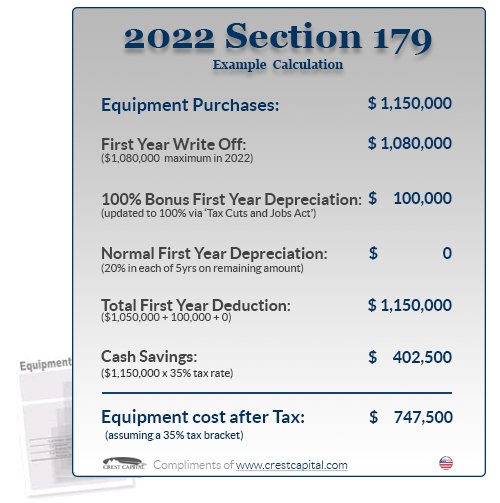

2022 Deduction Limit = $1,080,000 - This deduction is good on new and used equipment, as well as off-the-shelf software. To take the deduction for tax year 2022, the equipment must be financed or purchased and put into service between January 1, 2022 and the end of the day on December 31, 2022.

2022 Spending Cap on equipment purchases = $2,700,000 - This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced on a dollar for dollar basis. This spending cap makes Section 179 a true “small business tax incentive” (because larger businesses that spend more than $3,670,000 on equipment won’t get the deduction.)

Bonus Depreciation: 100% for 2022 - Bonus Depreciation is generally taken after the Section 179 Spending Cap is reached. The Bonus Depreciation is available for both new and used equipment.

HERE’S HOW SECTION 179 WORKS

In years past, when your business bought qualifying equipment, it typically wrote it off a little at a time through depreciation. In other words, if your company spends $50,000 on a machine, it gets to write off (say) $10,000 a year for five years (these numbers are only meant to give you an example). Now, while it’s true that this is better than no write-off at all, most business owners would really prefer to write off the entire equipment purchase price for the year they buy it.

And that’s exactly what Section 179 does – it allows your business to write off the entire purchase price of qualifying equipment for the current tax year. This has made a big difference for many companies (and the economy in general.) Businesses have used Section 179 to purchase needed equipment right now, instead of waiting. For most small businesses, the entire cost of qualifying equipment can be written-off on the 2022 tax return (up to $1,080,000).

For more details on limits and qualifying equipment, as well as Section 179 Qualified Financing, please read the entire Section 179 website carefully.